Exemplary Info About How To Settle A Collection Account

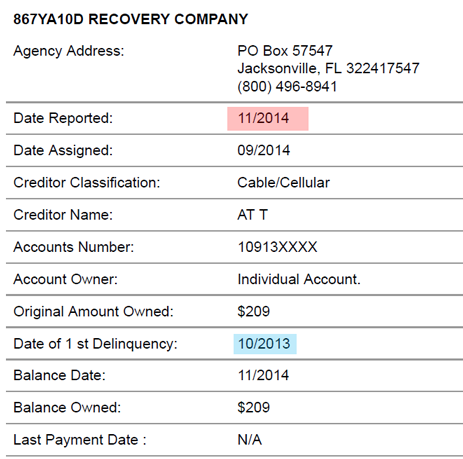

Before you do anything else, find out who your debt collector is.

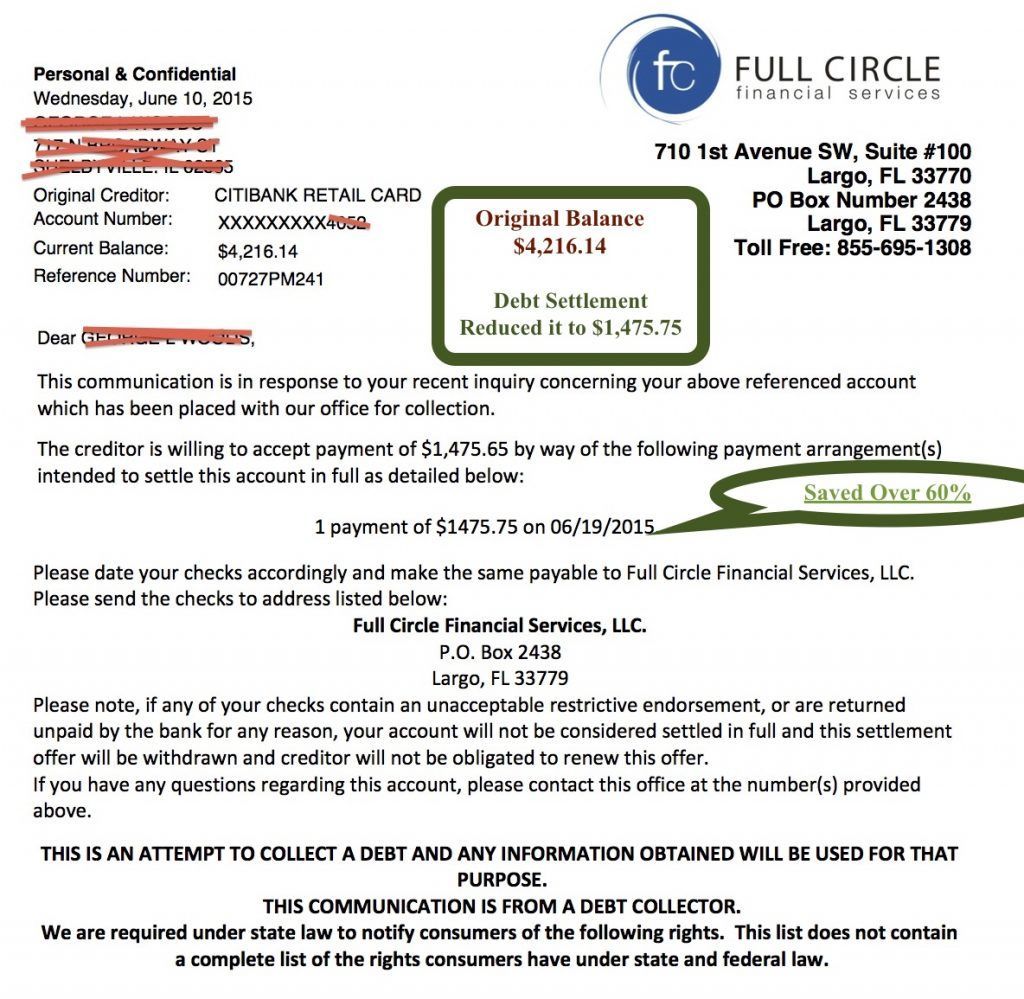

How to settle a collection account. Consider paying any unpaid collection accounts. Lenders aren't fans of any collection entry on your credit reports, but they're likely to view collections with a paid status more positively than. This indicates that the account is closed and that there is no longer a balance due.

Find out who owns your debt. To do this, find out. A summary of the full amount you owe.

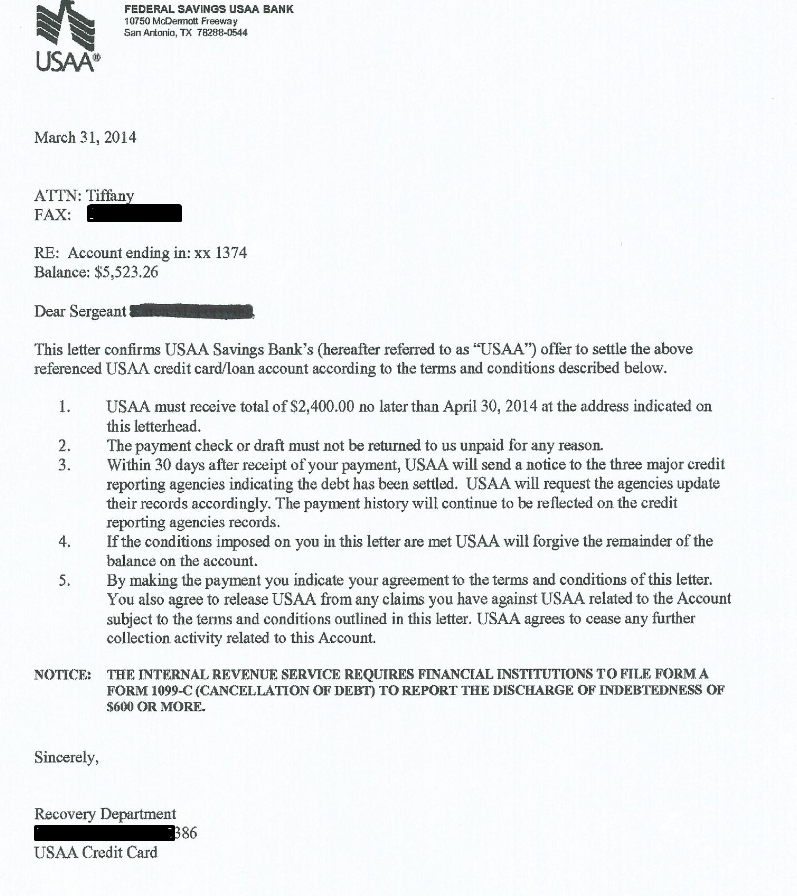

What to do if you are facing a debt collection lawsuit. Read the entire article by james l. Get a receipt from the collection agency for what you paid.

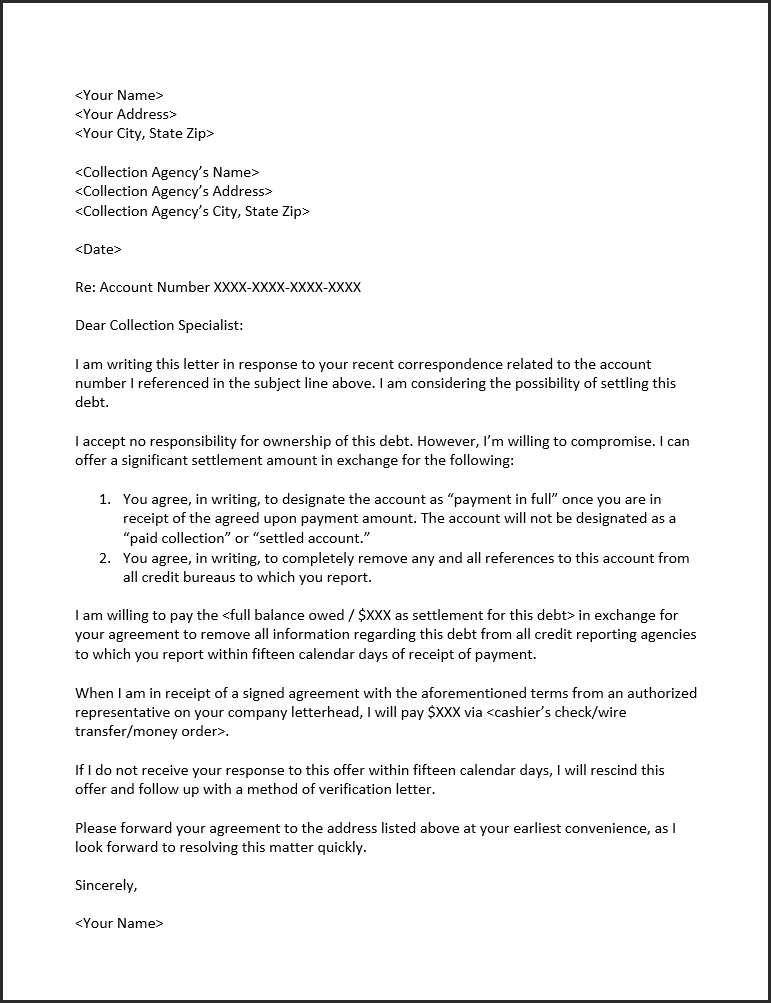

If it's not, you have three main options to pay off a debt in collections: Ultimately, a creditor or debt collection agency wants to get its money. Only communicate with debt collectors in writing & keep records.

Is it better to settle a collection or pay in full? Watch your debts dwindle sign up. The name of the original creditor, if it’s a collection account.

If you’ve decided to settle your medical debts in collections, you have two options: Keep copies of everything you send the agency, and everything they send you in a file. How to settle medical collection accounts.