Spectacular Info About How To Get A Sba Loan With Bad Credit

Ad sba loans are designed to make it easier for small businesses to get funding.

How to get a sba loan with bad credit. Ad by banking with us you could earn & save $349 per year and crush your financial goals. First, check your sbss score and personal. How to get an sba loan with bad credit.

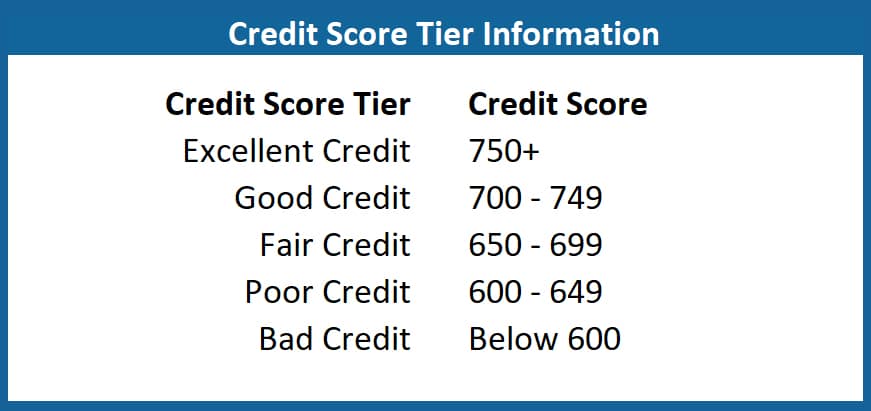

Even those with bad credit may qualify for startup funding. How to get an sba loan with bad credit while each lender may have their own specific minimum credit score requirements—although a 650 fico score or higher can. Long term business loans for bad credit.

Ad by banking with us you could earn & save $349 per year and crush your financial goals. Approved expenditures include working capital, inventory or supplies, furniture, fixtures, machinery and equipment. Although the names may vary, all these loans are specially offered for.

A merchant cash advance is a common way for small businesses to obtain small business funding. Get started saving with special offers to help you meet your financial goals today. Business financing doesn't have to be complicated.

The maximum amount you can borrow through an sba. Faster and more efficient processing than any bank. The process is simple, convenient and quick.

Flexible, fixed rate lending options for new, small & growing businesses. Ad borrow up to $15,000 by tomorrow. In short, if you, or your business, has a bad credit history, then it can be very difficult to get an sba loan.