Fantastic Tips About How To Be A Financial Planner In Canada

Financial planning may seem like.

How to be a financial planner in canada. The most recognized certification in canada and across the world is the certified financial planner certification. In canada, anyone can call themselves a financial planner and offer financial planning services. Financial advisors should have at least.

These individuals have several obligations, including: When you’ve completed all of. How a financial plan looks.

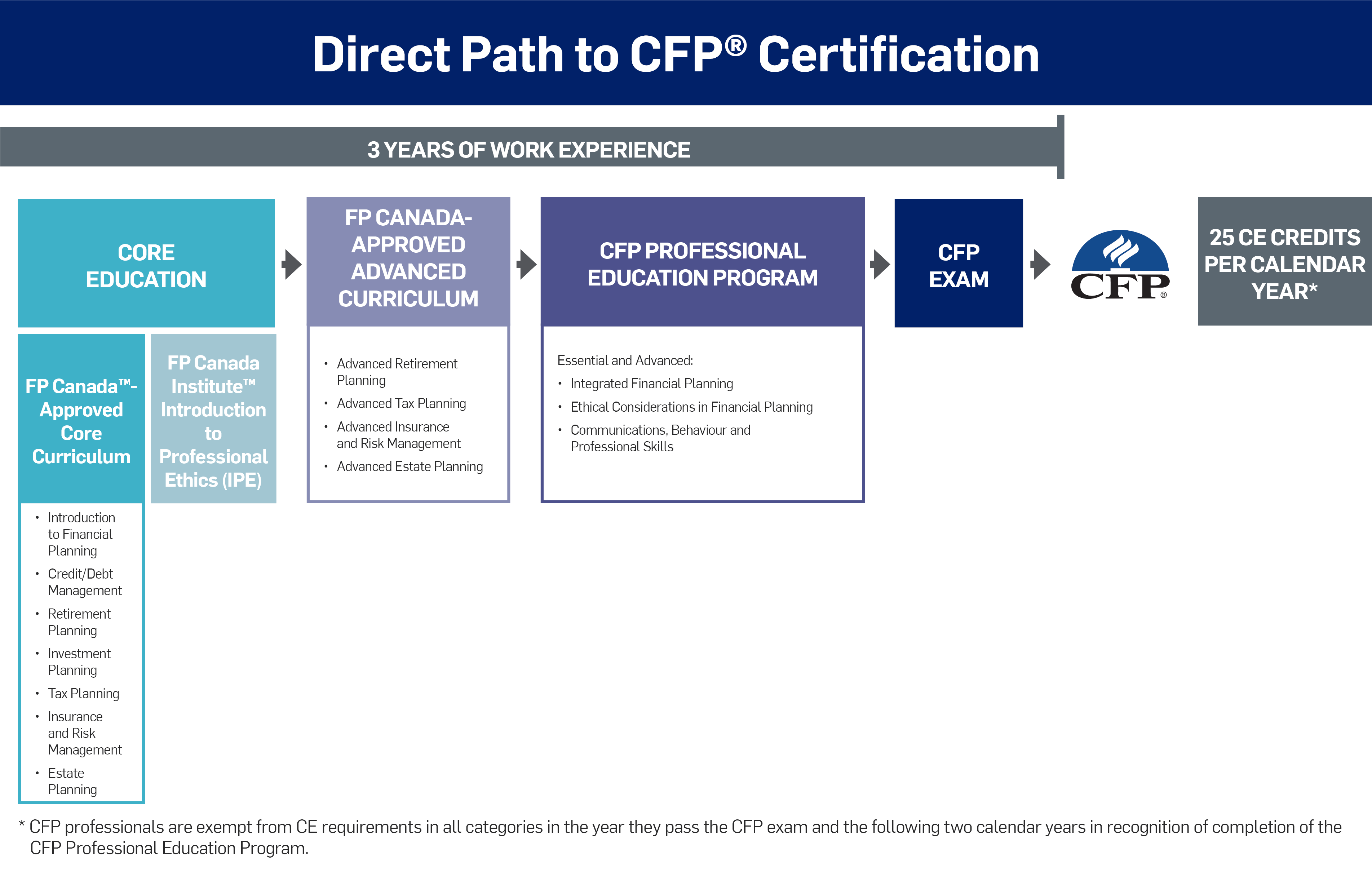

Before you hire a financial advisor, you’ll want to do your homework. Financial consumer agency of canada. Certified financial planner (cfp) exam chartered life underwriter (clu) exam examinations are offered by the canadian securities institute (csi) at exam centers located throughout canada.

Any financial planner you approach must have this certification. At a time when society is facing unprecedented disruption in all walks of life, canadians have a greater need. Many canadians think that financial planning is only about investing for retirement.

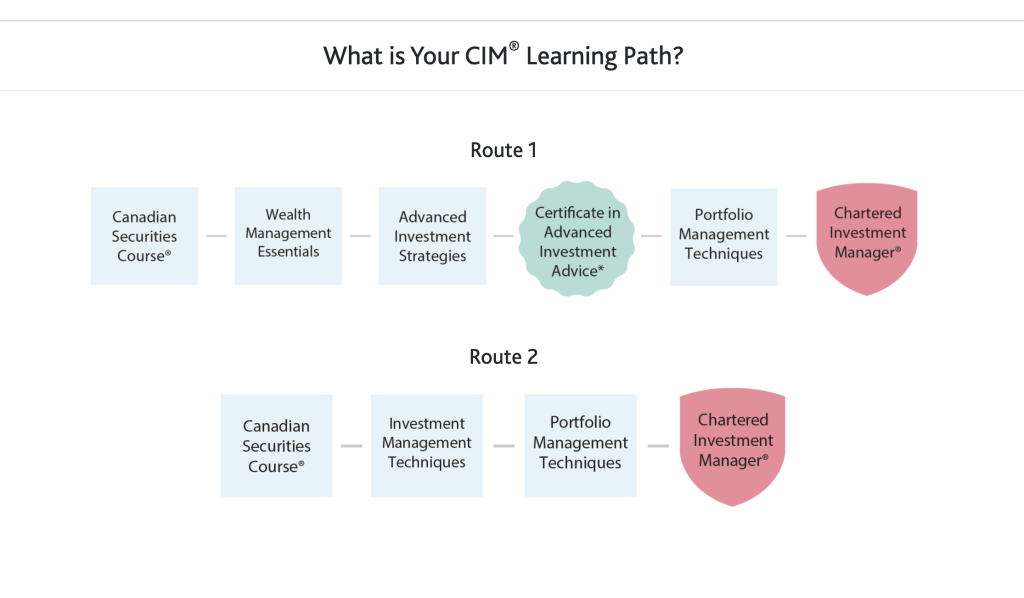

Make sure any planner you consider is a cfp ( certified financial planner ), rfp ( registered financial planner ), or cfa ( chartered financial analyst ). Personal and commercial banking job type:regular. Financial consumer agency of canada.

It is—but it's also so much. Qualified associate financial planner ™ certification is a great way to start your career in financial planning. Qafp professionals have demonstrated the knowledge, skills, experience, and ethics to understand their clients’ everyday financial planning needs and to provide holistic financial.